So, grab a cup of coffee and get comfortable, because here are ten thoughtful predictions aiming to shed light on where this technology is taking us, both as individuals and as a community. These predictions cover a broad range of issues—from the mass adoption of decentralized finance (DeFi) to institutional and environmental changes—providing a glimpse into the multitude of ways blockchain could reshape our world.

What are the future prediction of blockchain?

- Prediction 1: Blockchain for Identity Management – A Closer Look

- Prediction 2: NFTs Become the Standard for Digital Asset Ownership

- Prediction 3: Decentralized Finance (DeFi) Reaches Mainstream Adoption

- Prediction 4: Transparent and Efficient Supply Chains Powered by Blockchain

- Prediction 5: Tokenization of Real World Assets

- Prediction 6: Interoperability Between Different Blockchains

- Prediction 7: Government and Institutional Adoption

- Prediction 8: Environmental Sustainability

- Prediction 9: Decentralized Social Networks Take Center Stage

- Prediction 10: Blockchain in Healthcare Takes Of

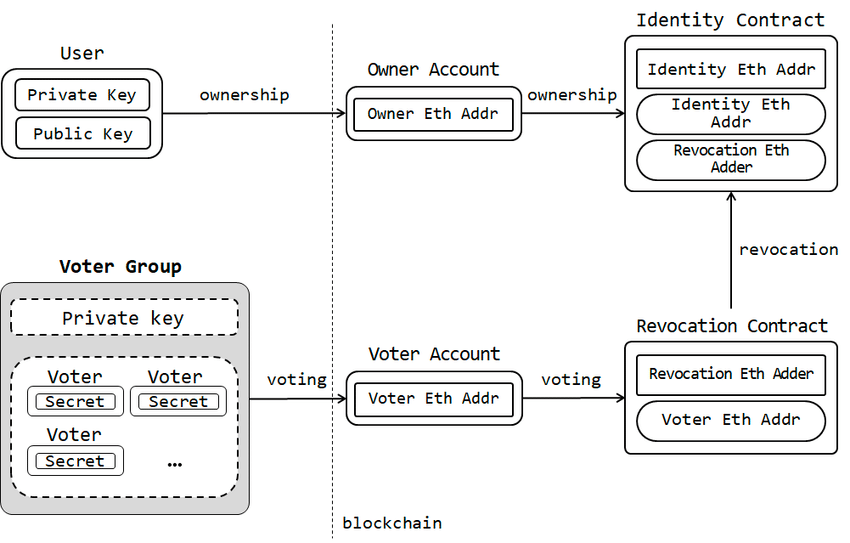

Prediction 1: Blockchain for Identity Management – A Closer Look

As we look ahead to the future of blockchain, one of the most impactful use-cases is poised to be in the realm of digital identity management. We’re gradually shifting from an era where centralized platforms and institutions had the authority to validate and control personal identities, to a new paradigm where individuals can assert control over their own digital personas. This shift is not just philosophical but deeply practical and can influence everything from data privacy to cybersecurity and beyond.

Today, individuals rely on third-party services such as Google and Facebook to manage their digital identities. These centralized services are not only susceptible to hacks but also wield an uncomfortable amount of control over user data. The decentralized architecture of blockchain offers an alternative by shifting the locus of control back to the individual. Imagine a world where you can instantly provide verified credentials—be it your university degree or medical history—without the intermediary of a centralized database.

Beyond individual benefits, the ripple effects of blockchain-powered identity management will be felt across industries. For instance, in healthcare, the secure and immutable record-keeping enabled by blockchain could revolutionize the way medical histories are stored and shared, enabling more personalized and efficient patient care. Similarly, in finance, a blockchain-based identity system could facilitate seamless and secure transactions, thereby eliminating the need for burdensome and often exclusionary verification processes.

All in all, the incorporation of blockchain into identity management systems is set to rewrite the rules of digital interaction, restoring data ownership and control to individuals while revolutionizing operational processes across sectors.

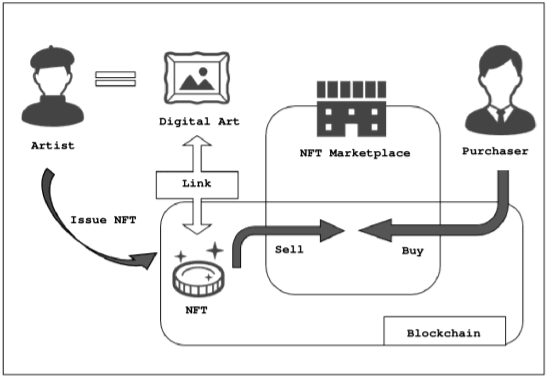

Prediction 2: NFTs Become the Standard for Digital Asset Ownership

Non-fungible tokens, more commonly known as NFTs, are well on their way to becoming a cornerstone in the ownership and transaction of digital assets. The intrigue of NFTs extends beyond the art world, where they initially gained prominence. The true power of NFTs lies in their ability to tokenize almost anything of value, thereby creating an unforgeable certificate of authenticity that resides on a blockchain. This ranges from a tweet, to real estate, to even pieces of the human genome in the future.

The impact of NFTs on asset ownership will be multidimensional. In the traditional paradigm, ownership is established through a complex web of legal documents, intermediaries, and centralized entities. Whether it’s a piece of art or a property deed, authenticity is typically validated through a centrally-controlled system that can be cumbersome, costly, and open to manipulation or fraud. NFTs, on the other hand, simplify this by offering a decentralized mechanism to prove authenticity and ownership. The token itself becomes a digital twin of the asset, making it easier to trade or transfer while ensuring that the provenance of the asset is transparent and secure.

While the revolution has already started in the fields of digital art, gaming, and collectibles, the utility of NFTs is beginning to stretch into more traditional asset classes. Imagine a future where your house deed or your car ownership could be represented as an NFT. This could not only make asset transfers more efficient but also open up new forms of asset liquidity. Fractional ownership could become straightforward, allowing people to invest in a slice of a Picasso painting or a prime real estate property with unprecedented ease.

Prediction 3: Decentralized Finance (DeFi) Reaches Mainstream Adoption

Decentralized Finance (DeFi) is not merely a buzzword or a theoretical concept. It’s a rapidly growing sector backed by hard numbers, with projections estimating that the DeFi market will soar to an impressive $231.19 billion by 2030. When you couple this with an expected Compound Annual Growth Rate (CAGR) of over 56%, it becomes abundantly clear that DeFi is on an accelerated track to reshape the financial landscape.

One of the core strengths of DeFi is its ability to democratize financial services, offering equitable opportunities without the need for traditional middlemen like banks. The technology provides a more secure, transparent, and open-source alternative to traditional finance. Regulatory compliance is increasingly becoming a feature rather than an exception in the DeFi space, providing an extra layer of security and reliability.

The influence of DeFi is also apparent in its acceptance by established financial institutions. A case in point is JP Morgan’s usage of Aave Arc, a permissioned adaptation of the popular DeFi protocol, Aave. The endorsement by such a heavyweight in the financial industry is not just significant; it’s groundbreaking, offering a glimpse into how traditional and decentralized financial systems can coexist and even complement each other.

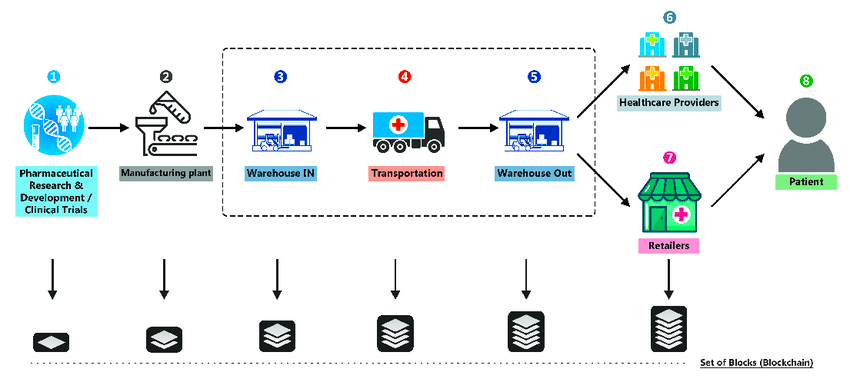

Prediction 4: Transparent and Efficient Supply Chains Powered by Blockchain

The integration of blockchain technology into supply chain management is a game-changer that promises to resolve longstanding inefficiencies and transparency issues. For years, companies have struggled with opaque supply chains, limited traceability, and inconsistent data. Blockchain promises to simplify this complexity by offering an immutable, transparent, and decentralized ledger that all parties can trust.

The impact of blockchain on supply chain transparency cannot be overstated. For companies, this will mean real-time updates on goods as they move from manufacturers to distributors to retailers. Gone will be the days of delayed shipments and opaque tracking information; with blockchain, each transaction is recorded in real-time and visible to all stakeholders, creating a new level of trust and accountability.

As these systems continue to evolve, they will likely include smart contracts that automate and streamline various processes, such as payments, receipts, and even compliance checks. These smart contracts will remove the need for intermediaries, cutting costs and reducing the time goods spend in transit. Imagine a world where shipping delays are the exception, not the rule, and where stakeholders can directly access a transparent record of a product’s lifecycle, from production to delivery.

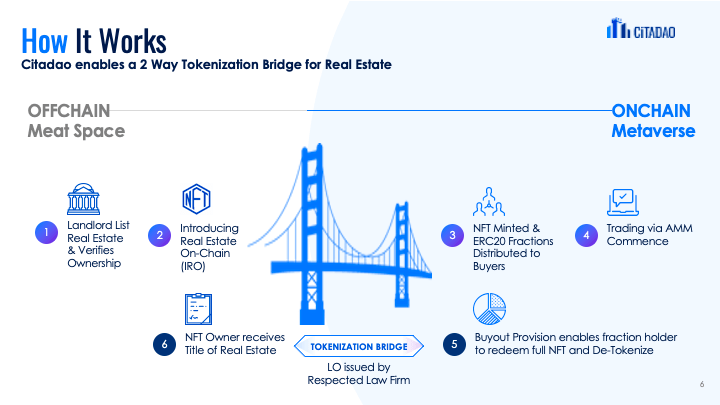

Prediction 5: Tokenization of Real World Assets

When it comes to leveraging blockchain for financial transformation, tokenization of real-world assets (RWAs) stands out as a compelling application with vast potential. Industry experts already recognize this as a trillion-dollar opportunity, aiming to upend traditional finance models and democratize asset ownership.

The genius of tokenization lies in its ability to fractionalize high-value assets, such as real estate, fine art, and even corporate debt. For instance, real estate, a traditionally illiquid asset class, can be tokenized into smaller, more manageable shares that can be traded effortlessly. This fractional ownership drastically lowers the barriers to entry, making it possible for retail investors to participate in markets that were previously only accessible to wealthy individuals or institutional investors.

The global real estate market size is estimated to be around $228 trillion. Tokenizing even a small fraction of that could unlock trillions in liquidity, allowing for far greater market participation. This is monumental when considering that fractional ownership could let more investors get a piece of the pie, regardless of their financial standing. No longer will multi-million-dollar properties be restricted to the elite; with tokens representing as little as a hundredth of a property, virtually anyone could become a real estate investor.

In traditional markets, selling a high-value asset like real estate could take months, and often involves numerous intermediaries—brokers, lawyers, notaries, and so on. Tokenization could drastically reduce these time frames to mere minutes while eliminating unnecessary third parties. This not only makes the process more efficient but also highly lucrative, attracting more capital inflow and making the market more dynamic.

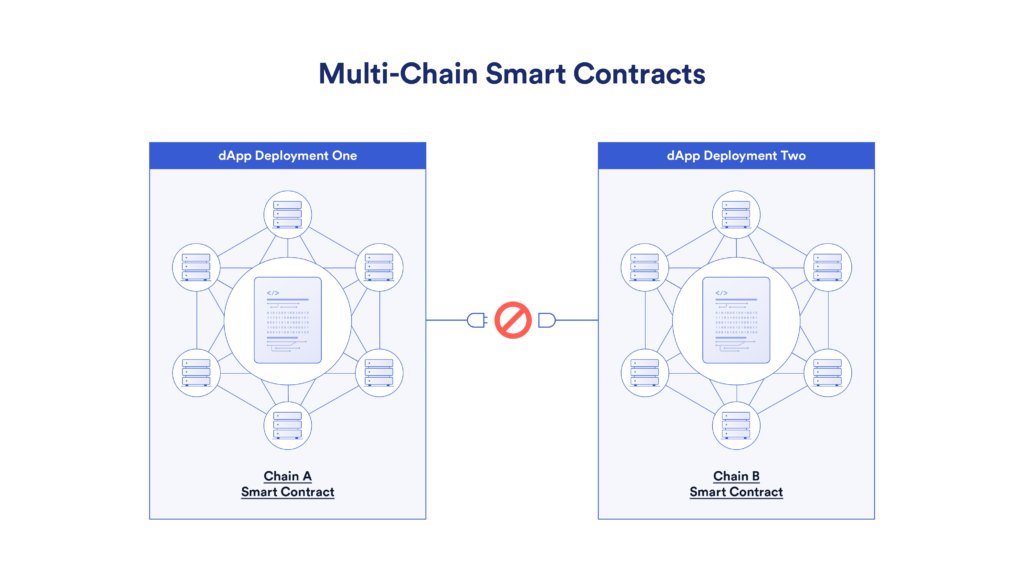

Prediction 6: Interoperability Between Different Blockchains

The increasing diversification of blockchain networks is both a testament to the technology’s utility and a challenge to its wider adoption. While individual blockchains offer unique capabilities and advantages, their siloed existence limits the overall effectiveness of decentralized systems. This is where the concept of interoperability takes center stage, acting as the connective tissue that binds these disparate ecosystems.

Why does interoperability matter? Think of it as the internet of blockchains—a series of interconnected networks that allow for enhanced functionality, efficiency, and user experience. For instance, a user could leverage assets from Ethereum to participate in a DeFi project on Binance Smart Chain or move NFTs from one blockchain to another, all without cumbersome workarounds or trust issues. By facilitating such cross-chain activities, interoperability enhances the liquidity and utility of all participating blockchains, making the market as a whole more robust and attractive to investors.

However, achieving this level of seamless interaction is easier said than done. It involves creating decentralized bridges and protocols that allow for the secure and efficient transfer of assets and data between different blockchains. As a result, development in this area is likely to spur a wave of innovation similar to how the API economy transformed the internet. Some projects, like Polkadot and Cosmos, are already laying the foundation for this interoperable future, but we’re only scratching the surface of what’s possible.

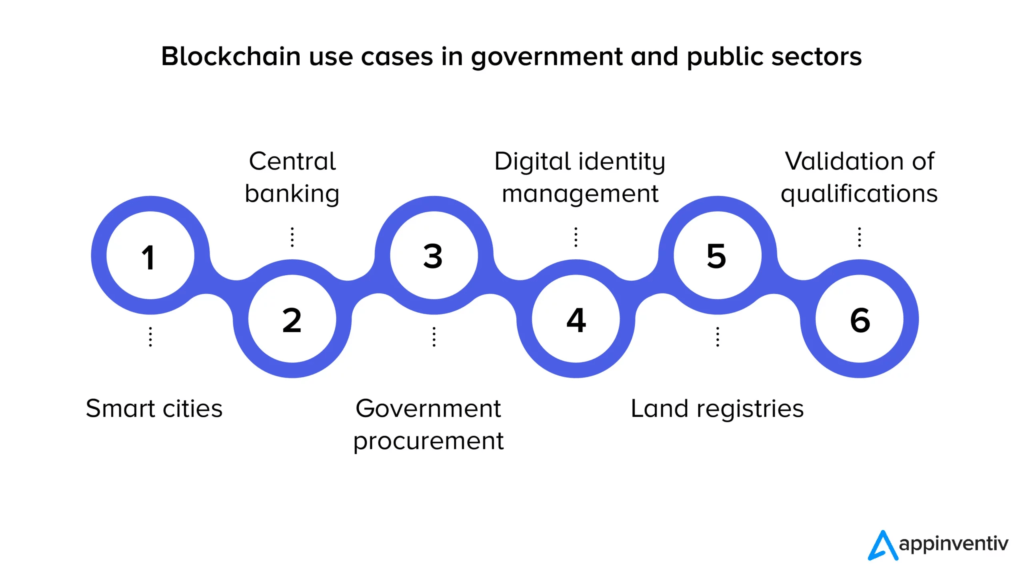

Prediction 7: Government and Institutional Adoption

The public sector is often viewed as slow-moving and resistant to change, but when it comes to blockchain technology, governments and institutions worldwide are showing increasing interest and commitment. Shifting from experimental pilot projects to full-scale implementations, these entities are beginning to recognize the unparalleled potential of blockchain for enhancing transparency, efficiency, and public trust.

Consider the example of Estonia, a country that has integrated blockchain into its digital identity, healthcare, and even judicial systems. In the United States, West Virginia tested a blockchain-based mobile voting platform in its 2018 mid-term elections, offering a glimpse of how secure and convenient voting could be in the future. Further, countries like Sweden and the United Arab Emirates are actively exploring the use of blockchain for land registries, aiming to simplify property transactions and eliminate fraud. These real-world applications not only serve as proof-of-concept but also drive home the viability and utility of blockchain in governance.

The journey from pilot programs to widespread adoption isn’t without its hurdles. Regulatory frameworks, data privacy concerns, and the requirement for large-scale infrastructure changes are significant challenges that need to be addressed. Yet, as these systems prove their worth, it becomes increasingly difficult for governments to ignore the cost-benefit ratio tilted in favor of blockchain adoption.

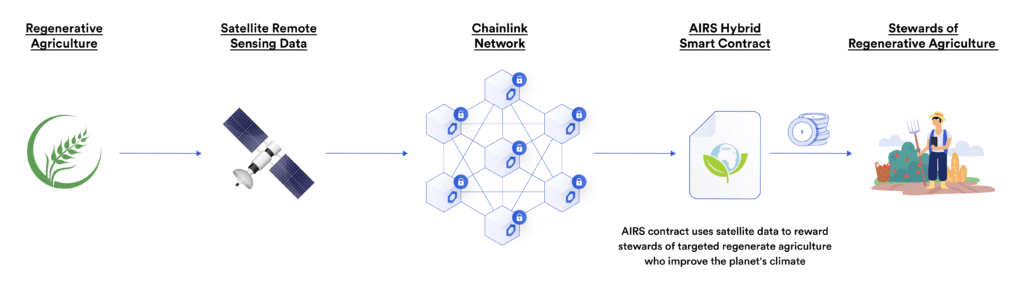

Prediction 8: Environmental Sustainability

The subject of energy consumption in blockchain, particularly in networks like Bitcoin that utilize Proof-of-Work (PoW) algorithms, has been a sticking point for critics. The energy-intensive nature of these algorithms often raises concerns about the technology’s sustainability and its potential impact on climate change.

Several next-generation consensus algorithms, like Proof-of-Stake (PoS), Delegated Proof-of-Stake (DPoS), and Proof-of-Authority (PoA), are already making waves in the blockchain community. These algorithms offer comparable security but consume significantly less energy. For instance, Ethereum, the world’s second-largest blockchain network by market cap, transitioned from PoW to a PoS system called Ethereum 2.0. This transition reduced the network’s energy consumption by up to 99%.

The move towards greener blockchain isn’t just about appeasing critics; it’s also about widening the technology’s appeal and fostering social acceptance. An environmentally sustainable blockchain could be a game-changer in attracting industries that have so far been wary of adopting the technology due to its ecological footprint. Think of sectors like clean energy, environmental conservation, and sustainable agriculture, where the integration of a ‘green’ blockchain could create unprecedented efficiencies and transparency.

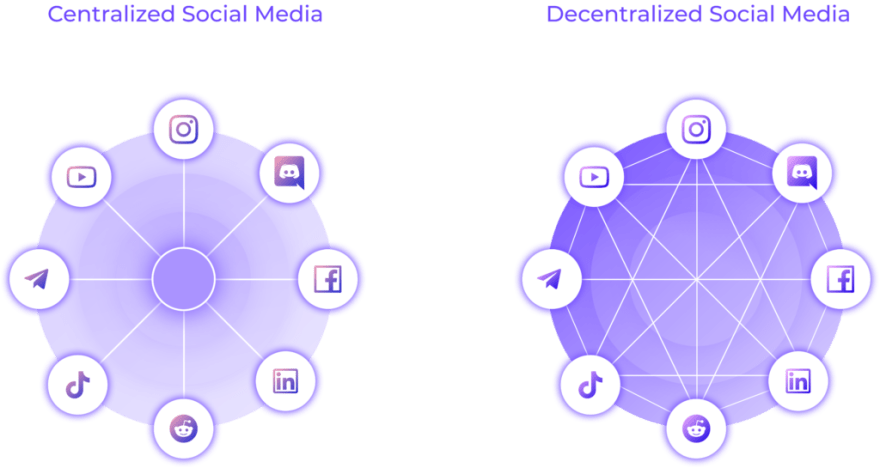

Prediction 9: Decentralized Social Networks Take Center Stage

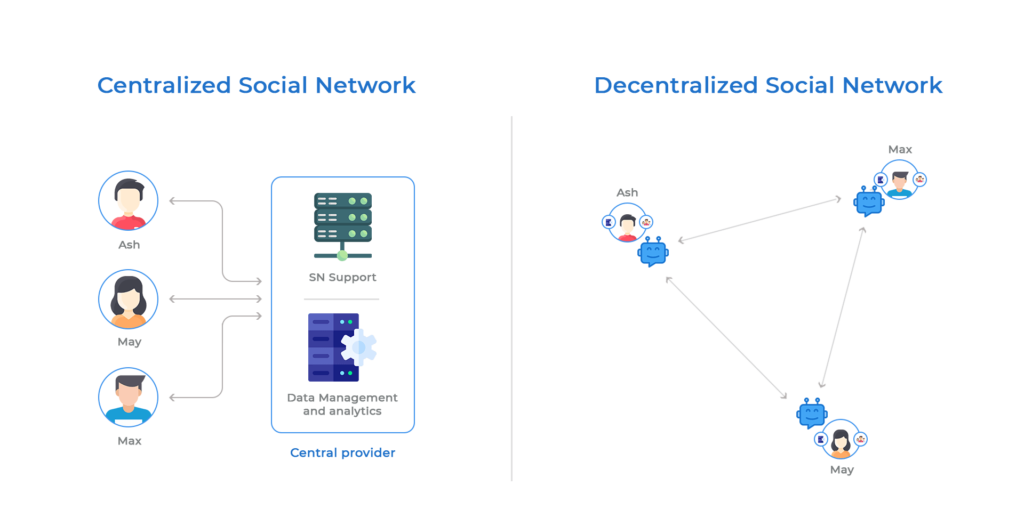

As concerns around data privacy, censorship, and corporate control continue to escalate, the next decade will likely see the rise of decentralized social networks. Unlike traditional platforms where a single entity owns the data, decentralized networks will empower users to take control of their personal information, digital assets, and online interactions. This democratization of data will change the dynamics of online communication, advertising, and content creation.

Blockchain-based social networks could revolutionize the way we think about digital identity, content monetization, and online community governance. For instance, imagine a platform where you could truly own your digital assets, be it a blog post, a video, or even a tweet, and transact directly with your audience without any middlemen taking a cut. The advertising model could shift from corporate-controlled algorithms to user-centric, opt-in advertisements, giving individuals more control and potentially better financial returns.

The burgeoning success of decentralized applications (dApps) in various sectors is a positive indicator for the feasibility and scalability of decentralized social networks. The rise of governance tokens and decentralized autonomous organizations (DAOs) can also enable more democratic community governance models, letting users vote on platform rules, changes, and even algorithm tweaks.

Prediction 10: Blockchain in Healthcare Takes Off

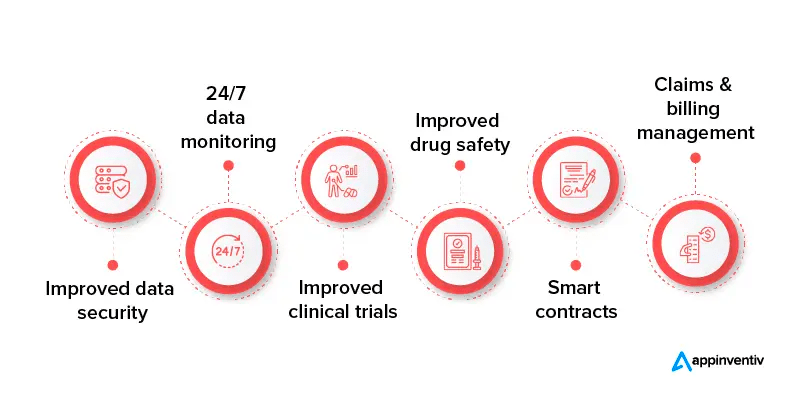

The inefficiencies and centralized control issues in healthcare today may find a solution in blockchain technology. Over the next decade, expect to see blockchain systems being used for medical records, drug traceability, and even healthcare-related financial transactions. The blockchain can ensure data integrity, multi-party compliance, and secure, instantaneous access to medical histories.

By providing a single, immutable record, blockchain will address a significant pain point in healthcare: data fragmentation and inaccessibility. Patients will have ownership of their medical data and can provide access to various service providers as needed, without risking data corruption or unauthorized alteration. This not only streamlines administrative workflows but also facilitates more personalized care based on accurate, comprehensive patient data.

What amplifies the likelihood of this trend is the escalating global healthcare crisis and the urgent need for streamlined, secure systems that both healthcare providers and patients can trust. Blockchain could facilitate rapid, transparent response efforts in health crises, from pandemics to drug recalls. For instance, blockchain could be employed to create a transparent and unchangeable ledger of vaccine distribution, ensuring accountability at every step.

Conclusion : does blockchain really have a future?

As we peer into the next decade, the potential of blockchain to disrupt multiple sectors is not just an optimistic projection—it’s an impending reality. Each prediction we’ve examined isn’t merely a lofty dream; it’s backed by emerging trends, technological advances, and a global appetite for decentralized solutions.

From redefining digital identity to reimagining asset ownership, financial transactions, healthcare, and supply chains, blockchain is poised to seep into the very fabric of our daily lives. Mainstream adoption is no longer a question of “if” but “when” and “how.” Industry leaders are not just speculating; they’re placing their bets on blockchain technologies, injecting billions into its research and application.

Even sectors traditionally resistant to change, such as healthcare and government, are not immune to the blockchain wave. These institutions are shedding their cautious approach, transitioning from pilot projects to full-scale implementations. As this happens, not only will the technology itself mature, but its public perception will undergo a transformation from skepticism to trust.

What amplifies these predictions from mere conjecture to plausible outcomes is the undeniable gravitational pull that blockchain has on modern society’s most complex challenges—transparency, efficiency, security, and equitable access. As blockchain technology evolves and integrates into the mainstream, it won’t just be a tool for change; it will be the foundation for a more decentralized, transparent, and equitable global ecosystem.

In a world that often feels like it’s fraying at the edges, blockchain offers the thread to weave it back together. As we move forward, expect to see this revolutionary technology become as ubiquitous and essential as the internet is today. The future is not just blockchain-enabled; it’s blockchain-driven.